- Executive Moves

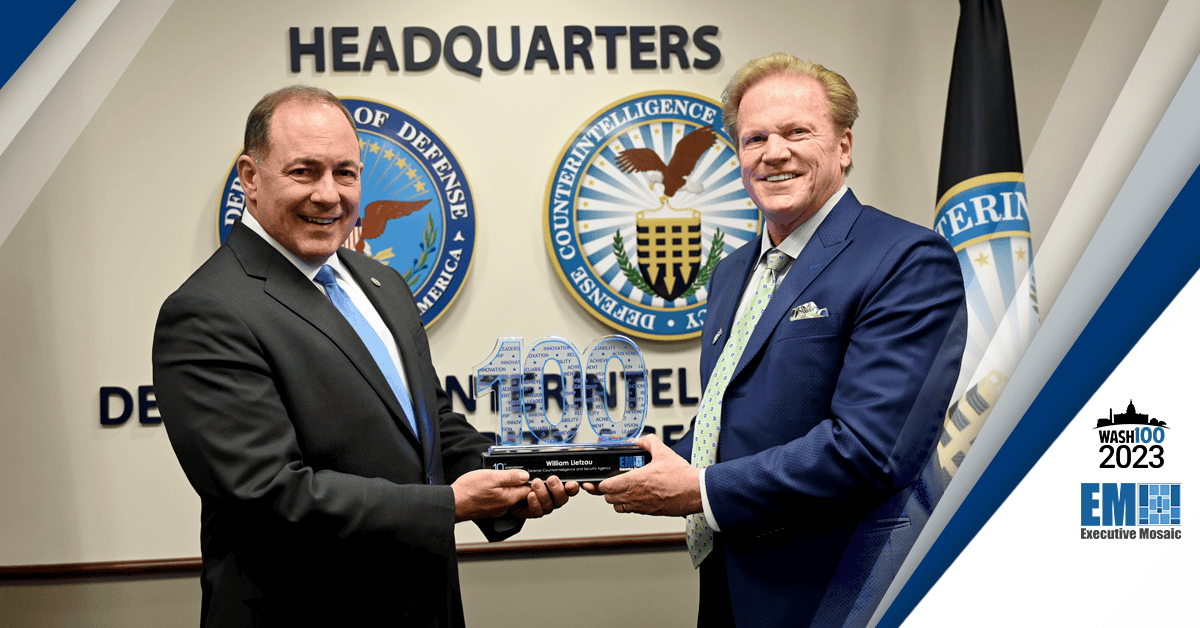

William Lietzau has stepped down from his role as director of the Defense Counterintelligence and Security Agency, marking his retirement from federal service. The former DCSA director and 2023 Wash100 Award winner was recognized on Thursday in a Transfer of Authority ceremony, held at the National Museum of the Marine Corps. The eve...