A report by consulting firm McAleese & Associates says Lockheed Martin (NYSE: LMT) saw its fiscal 2018 sales rise 8 percent to $53.8B and the increase was primarily driven by revenue growth in the Bethesda, Md.-based company’s aeronautics and missiles and fire control segments.

Jim McAleese, founder and principal of McAleese & Associates and a 2019 Wash100 winner, wrote the 35-day partial government shutdown did not have an impact on the latest financial results of Lockheed.

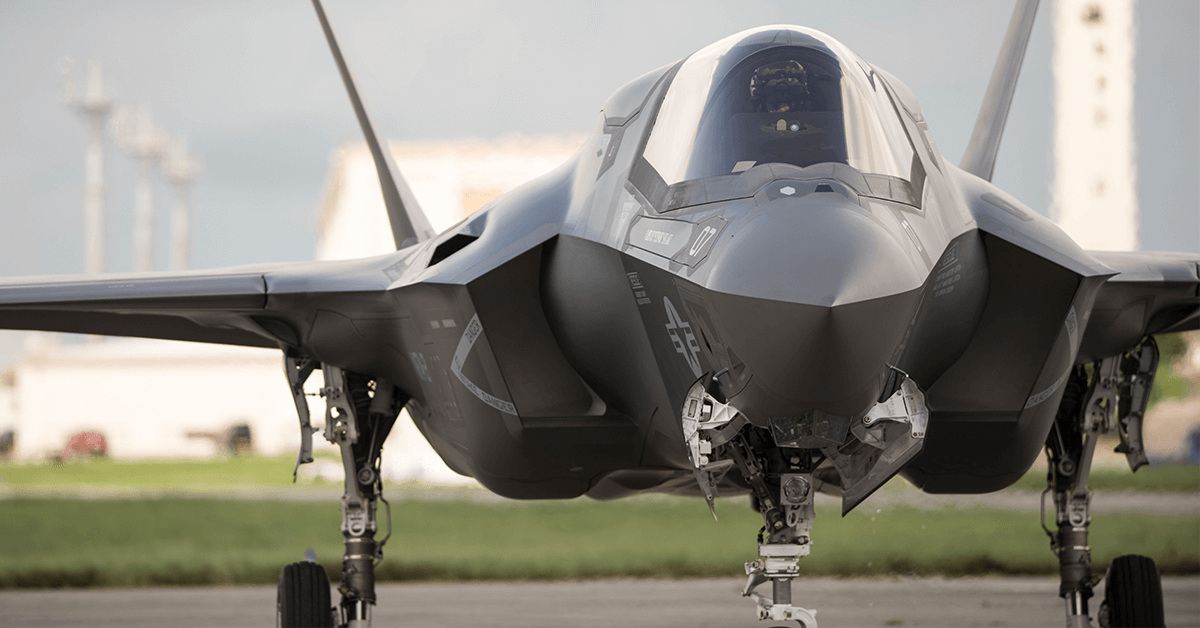

Aeronautics business revenue in the fourth quarter grew 4 percent from the same period in 2017 and 9 percent on a full year basis, which Lockheed attributed to increased volume on F-35 production and sustainment efforts. MFC — which houses tactical and strike missile programs — showed jumps of 22 percent and 16 percent over the same respective periods.

“Our F-35 aircraft backlog has grown to nearly 400 planes, a level which exceeds the total of 35 deliveries we’ve made to-date, a clear sign of the program’s momentum,” Marillyn Hewson, Lockheed CEO and also a 2019 Wash100 awardee, said during a recent earnings call.

“We continue to work with the F-35 joint program office to finalize the full order of lots 12, 13 and 14, which once completed will represent a total of 478 aircraft.”

Lockheed’s rotary and mission systems segment posted a $587M increase in 2018 sales and a $43M decline in Q4 sales, while the space segment registered increases of $203M and 49M for the three- and 12-month periods.

McAleese added the aerospace and defense contractor is looking to primarily increase its capital expenditure in MFC business activities related to the production of missiles for the U.S. Army, Terminal High Altitude Area Defense systems for the Missile Defense Agency and hypersonic weapons.