Lockheed Martin (NYSE: LMT) — one of 30 companies listed on Executive Mosaic’s GovCon Index — has reported third quarter earnings of $2.77 per share, five cents higher than the consensus Wall Street estimate and one cent above EPS figures reported for the prior year period.

Lockheed Martin (NYSE: LMT) — one of 30 companies listed on Executive Mosaic’s GovCon Index — has reported third quarter earnings of $2.77 per share, five cents higher than the consensus Wall Street estimate and one cent above EPS figures reported for the prior year period.

Profit declined 2.6 percent from the same quarter in 2014 to $888 million and third quarter 2015 revenue increased 3.2 percent from the prior period to $11.46 billion, which beat the consensus estimate of $11.14 billion.

The company updated its full-year guidance to $11.30 earnings per share and $45 billion in revenue and both figures are at the top end of the previous ranges of $11.00-$11.30 and $43.5 billion-$45 billion respectively stated in July.

Wall Street estimates the company’s full-year 2015 earnings at $11.38 per share and revenue of $44.82 billion.

Lockheed expects its sales for 2016 to be comparable with 2015 figures.

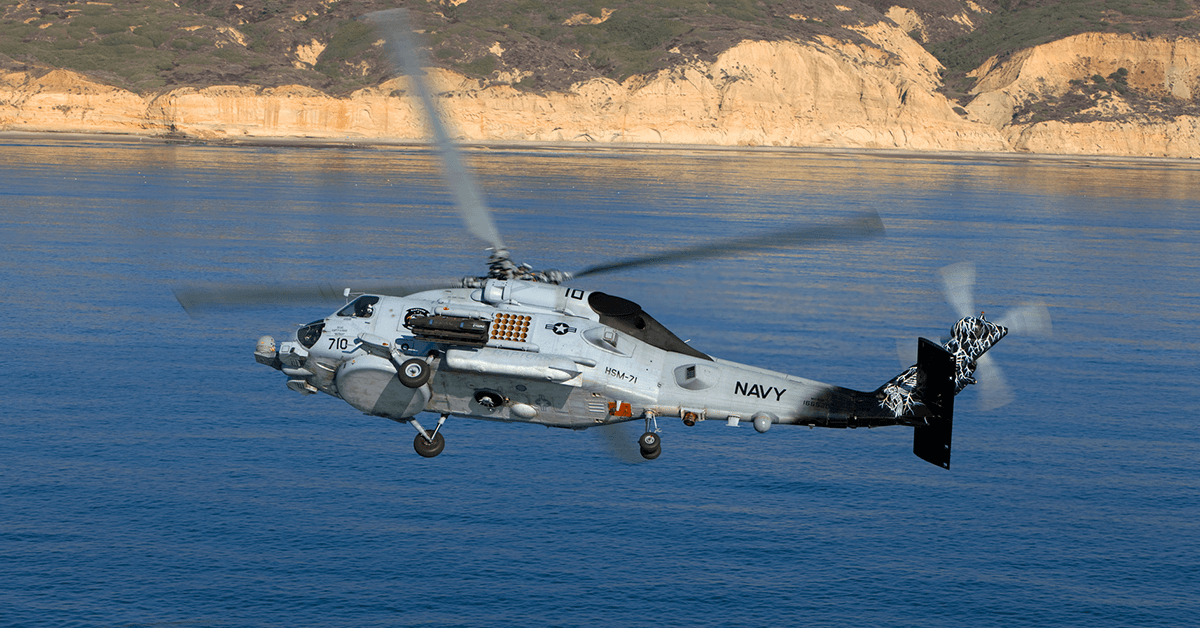

The company outlooks for 2015 and 2016 do not include the planned separation of portions of its information systems and global solutions business and the pending $9 billion acquisition of helicopter maker Sikorsky Aircraft from United Technologies Corp. (NYSE: UTX).

Lockheed intends to both release its future plan for the IS&GS segment and close the Sikorsky acquisition by the end of the year, CEO Marillyn Hewson told investors in a Tuesday morning conference call.

Hewson told investors the company could carry out the separation of the estimated $6 billion in IS&GS portions via a direct sale, spinoff to shareholders or through a Reverse Morris Trust transaction.

She also said the company is awaiting final regulatory approval for the Sikorsky transaction from China prior to the deal’s closure.

Third quarter 2015 sales in Lockheed’s aeronautics segment rose 10.6 percent from the prior year period and mission systems and training recorded a 7.3 percent increase from the same quarter in 2014.

Revenue in the IS&GSÂ segment declined 4.1 percent year-over-year and space systems by 5.1 percent from the prior year period.

Lockheed’s stock has risen 9.65Â percent since the start of the year and is up 22 percent for the last 12 months.